Understanding Major ESG Reporting Frameworks

GRI is the most widely used framework worldwide, focusing on sustainability’s environmental, social, and governance aspects. It emphasizes materiality and stakeholder inclusivity.

- Task Force on Climate-related Financial Disclosures (TCFD): Climate-specific reporting.

- CDP: Focused on environmental performance like carbon emissions and water use.

- Stakeholder Needs: Align your choice with investor and stakeholder expectations.

- Regulatory Requirements: Consider mandatory reporting obligations in your region or sector.

- Industry Relevance: Some frameworks, like SASB, cater to specific industries.

- Global vs. Local Focus: Global frameworks may suit multinational companies, while local ones may be better for region-specific compliance.

- Resource Availability: Complex frameworks might require more time and expertise.

- Data Complexity: Collecting and consolidating ESG data across departments is time-intensive.

- Framework Alignment: Ensuring the organization’s operations align with multiple reporting frameworks.

- Real-Time Updates: Keeping up with evolving regulations and stakeholder expectations.

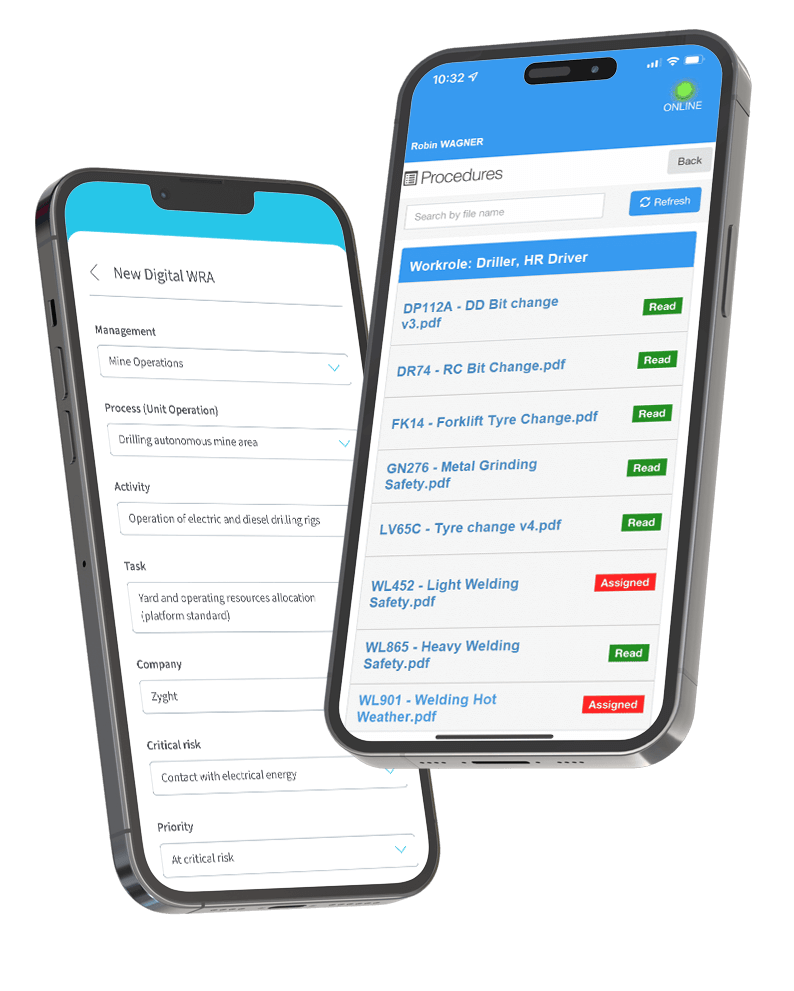

iSystain is a powerful ESG reporting solution designed to address these challenges. Here’s how it helps:

iSystain’s intuitive platform centralizes ESG data collection, automating processes to save time and reduce errors.

The software supports major frameworks like GRI, SASB, and TCFD, enabling seamless compliance with multiple standards.

With real-time dashboards, iSystain allows organizations to track performance, identify gaps, and proactively address ESG risks.

iSystain stays updated on the latest regulatory changes, ensuring your reports always meet compliance requirements.

As ESG expectations grow, adopting the right reporting framework and tools is essential. By understanding major frameworks, considering critical factors, and leveraging software like iSystain, organizations can confidently meet stakeholder demands and regulatory obligations.